If you ever get into a situation in which you have an insurance premium auditing, you want to be in the hands of the experts. Learn more about this industry in the infographic below:

If you ever get into a situation in which you have an insurance premium auditing, you want to be in the hands of the experts. Learn more about this industry in the infographic below:

The world of insurance inaccuracy is a costly matter – but the future is looking bright. OCR technology has lead to the innovation of insurance card scan and verification. Learn more about the impact to the health insurance industry in the infographic below:

While it is a protected right to own a legal firearm, it may soon become local policy to also require having gun liability insurance. Learn more about the ins and outs of gun liability insurance in the visual deep dive below, courtesy of US Insurance Agents:

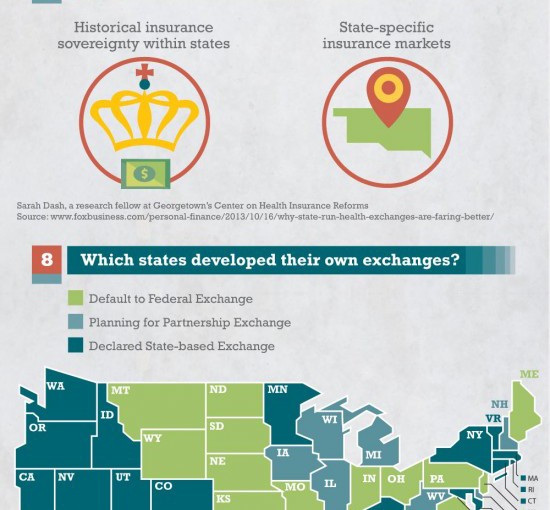

Healthcare.gov definitely had a rocky start. This infographic presented by Galorath provides a deeper look into why this was the case. Check it out below to learn more.

Embedded from Galorath

Do you know what happens to the funds invested in a life insurance policy when you die? This must-see infographic presented by InsuranceQuotes.com cites the payoff of debts and funeral cost among others. Read on to discover how investing in life insurance today will remove some uncertainty and provide some security for the ones you love.

From: Bankrate Insurance’s insuranceQuotes.com

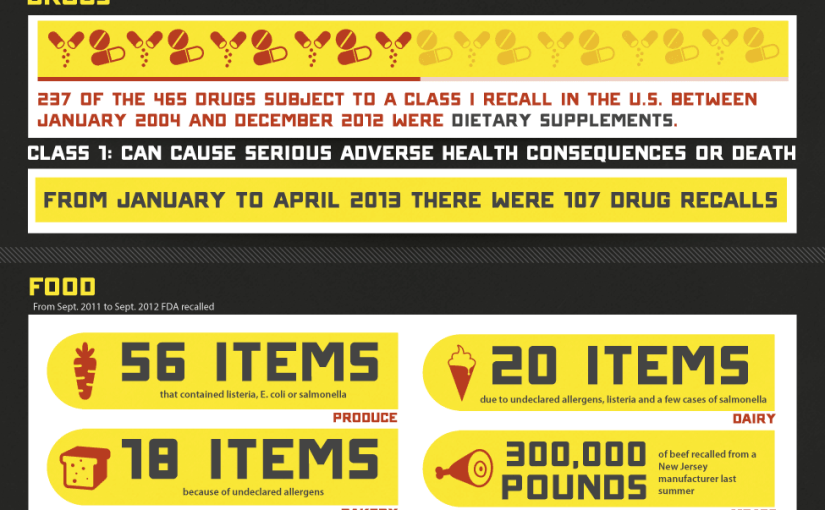

With the frequency and cost of product recalls, it is important for a business that sells products to the public to protect themselves. Recalls happen in every industry, though most frequently in the automotive, pharmaceutical, food, and child product industries. Recalls cause a lot of damage to a business, in cost of the recall, as well as the potential liability risks. Business insurance can spare a company from costs of a recall, as well as from settlement and legal fees, if sued.

Learn about the worst recalls in history, and what else business insurance can protect a company from, in the infographic below, presented by InsuranceQuotes.com.

From: Bankrate Insurance’s insuranceQuotes.com

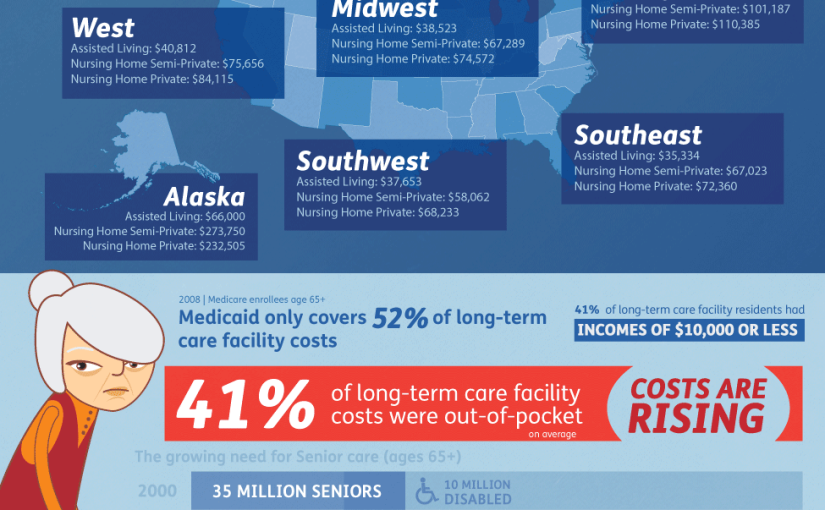

It is highly likely that you will require long-term care at some point during your life. Seventy percent of people ages 65+ will need long-term care, and of those who already have long-term care needs, 42 percent are under age 65. The costs and risks of not having long-term care insurance go up with age. It is important to protect your retirement and your family from high costs that could have been prevented, had you acquired insurance earlier.

Learn more about the importance of acquiring long-term care insurance in the infographic below, presented by AssurePlan.

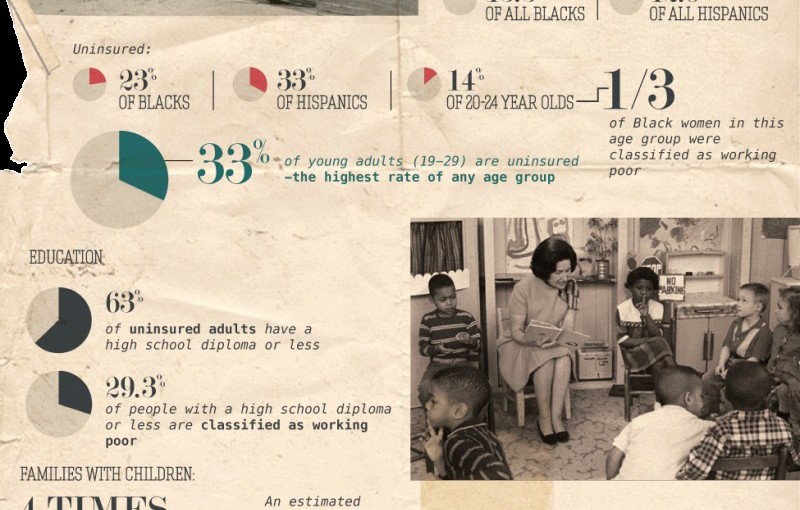

America has a serious economic and social problem. The U.S. currently has around 50 million citizens living below the poverty line, 10.4 million of which are considered “working poor.” Working poor citizens are those who currently hold jobs that do not provide them with enough financial support to put them above the poverty line. The large majority of these people find it incredibly difficult to afford proper insurance, and this is not a good thing for U.S. society. Check out the infographic below presented by InsuranceQuotes to learn more about this issue.

From: Bankrate Insurance’s InsuranceQuotes.com

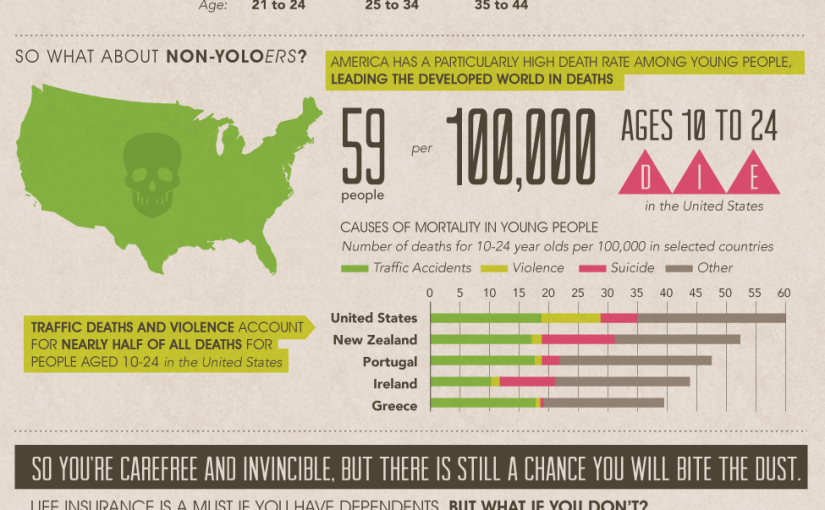

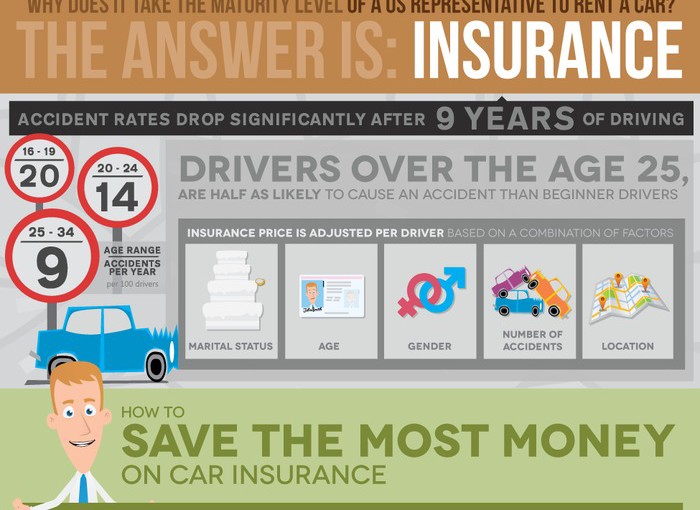

Here is an infographic from Auto Insurance Center about why the price of insurance drops when you reach the age of 25 with sections about car rental companies, accident rates and how to save the most money on car insurance.

To see a full size version of the infographic click here.